Banks around the globe have realized that investments in digital technologies are ways to acquire new customers.

According to the survey by Deloitte, banking systems and user behaviour vary between different markets and geographic regions.

Consumers also show that they are ready for a higher level of engagement with banking channels.

See a couple of interesting numbers below:

- 84 percent uses online banking services.

- 72 percent use mobile applications to access their operations.

Banks that have completed their digital transition, may look at a streamlined process with engaging CX.

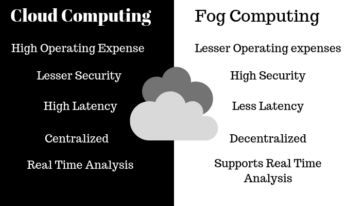

One can't deny that cloud computing is revolutionizing the business ecosystems of various industries, and banking is no exception.

Acting in an increasingly worrying scenario, where measly milliseconds can mean losses of hundreds and thousands of shares, institutions need agility in their operations while reducing costs.

Here's how cloud computing has helped banking with digital transformation.

-

- Offering agility to respond to the market.

- Dramatically reducing operating costs.

- Promoting environmental sustainability.

- Ensuring business continuity.

Nowadays, those banks that continue to operate with expensive and inflexible systems are at great risk of being put out of the market.

Your managers need to know that only with cloud-based solutions, they will be able to react quickly to the challenges.

It is well known that the banking sector is increasingly adopting technology to make its services more convenient for its customers.

The applications of AR in companies in the banking sector are endless and promise to bring greater efficiency to the daily lives of these companies.

The Federal Bank of India provides all the bank-related notifications via AR when viewed on a smartphone. Also, the National Bank of Oman provides AR mapping services for customers to locate branches and ATMs.

When #MobileBanking meets #AR >>> @admixco via @MikeQuindazzi >>> #FinTech #DigitalBanking #VirtualReality #VR #AI #IoT #FinServ >>> https://t.co/hXOEdvKAa3 pic.twitter.com/lYsZmDNzoj

— Mike Quindazzi (@MikeQuindazzi) November 17, 2019

As a customer of a bank, imagine receiving a bank card at your home, just by pointing your phone at the card.

And then you’ll be able to see the location of each transaction, your balance, and even able to make AR payments.

Also Read: Six Digital transformation strategies to grow your business in 2019

Big data in the banking sector has transformed the way of thinking about products and services offered to consumers, based on data analysis.

And this technology continues to benefit financial institutions, especially banks. These companies are becoming increasingly attentive to the needs and preferences of their customers.

Here are the advantages of using this technology:

-

- Optimizing customer service.

- Fraud prevention and detection.

- Risk management and protection from attacks.

- Customization of products and services.

- Reduction in churn rates.

The digital transformation which is taking place at the moment in the banking sectors & the digital products they offer brings a number of benefits to customers.

The big data is a technology that can be used to nourish the relationship between the bank and the consumer.

This is because, the organization can store a huge amount of information about the customer, facilitating the technical analysis of their tailored preferences.

The first advantage that a digital bank customer realizes is autonomy, as he can access his account and move his money in real-time, from anywhere. With digital banks, account control is entirely done by the user.

An internet connection is enough for the customer to be able to pay their bills, transfer money or even invest in various options in the financial market.

By relying on new technologies via the Internet first, then smartphones and tablets, digital banks have enhanced the relationship between credit institutions and their customers.

Nowadays, most banks render applications that can be installed on devices and used to carry out some basic tasks of a digital account.

Banks are constantly evolving, wherein the objective is to be always available and deliver the best services. This, in turn, helps attract the maximum number of customers, maximizing their profitability.

The new-age consumer does not want to be held captive by analogue banking services. They do not want to waste time in queues.

That is why digital products are so attractive to new generations of consumers, who value their time and freedom. Being served quickly and simply is what most of them are looking for today.

Owing to all the digital advancements that have come in, banks have come a long way. Up-gradation has always been a constant in the age of never-ending demands.

Online shopping portals, individual banking apps, and e-wallets have allowed people to take full advantage of the bank's services.

Any banking organization not keeping up with all these changes is sure to lag behind.

One of the challenges of banking institutions today is sustaining a relationship with the consumer-focused on positive experiences.

This lack of interaction coupled with the low availability of digital services ends up directly affecting the customer abandonment rate.

In this scenario, the aforementioned big data is a solution that banks can adopt. This tech is capable of storing all the preferences of a particular customer and use them when required.

In this way, the institution could provide personalized products to its client, guaranteeing their satisfaction and improving the relationship with the bank.

You may also like to read: The Role of Cloud ERP in Digital Transformation