Regardless of whether you’re doing online or offline business, streamlining your payment policies is a must for both your efficiency and your customer satisfaction. But there’s no doubt that the rise of multiple e-wallets and other digital payment methods has created policy challenges for online businesses trying to reach consumers with diverse preferences.

Addressing the diversity in preferred payments is a challenge that’s worth meeting if you want to improve your bottom line, and fortunately enough, one that’s easy to solve if you know what to do. Once you consolidate your payments with a better online payment gateway, like the types offered by the Philippines’ Maya Business, you can expect these benefits for your e-commerce business:

Increased customer trust and loyalty. Clear and concise payment policies remove confusion and allow your site to build customer confidence. Customers need to know exactly what to expect during the checkout process before they pay, and better payment policies will help secure that purchase as well as future ones made out of a sense of customer loyalty.

Expanded operational efficiency. Managing multiple payment policies for different situations can be cumbersome and may actually cost your business more than you think you’re saving. Consolidation takes away the burdens of this process, which gives you more time to focus on meaningful growth and customer engagement.

Effortless financial security and legal compliance. A unified payment policy makes it easier for your business to adhere to the latest security standards and regulatory requirements. Since there are fewer policy areas to consider, a unified policy greatly minimizes the risk of fraud and legal issues.

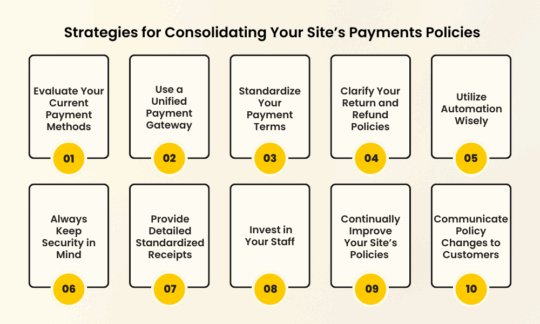

Strategies for Consolidating Your Site’s Payments Policies

Properly consolidating your payments is usually a matter of doing several small things more effectively. Try these tips to speed up the process without risking losing out on customers’ payments:

1) Evaluate Your Current Payment Methods

Start the consolidation process by reviewing all the payment methods you currently accept. Identify which ones are most popular among your customers and prioritize these when rewriting your policies. You can also consider phasing out less-used options or reconfiguring them so that they’re easier for customers to understand.

2) Use a Unified Payment Gateway

Rather than cluttering your checkout pages with multiple payment paths, offer your customers a single payment gateway that supports multiple payment methods. Having just one gateway that can handle all credit cards, digital wallets, and QR Ph codes reduces complexity and ensures a smoother transaction process.

3) Standardize Your Payment Terms

With so many different payment methods being used in the Philippines, it’s not uncommon for businesses to have inconsistent or even contradictory payment terms from method to method. Identify these inconsistencies and develop a more consistent set of payment terms that apply to all transactions, prioritizing key areas such as due dates, late fees, and refund policies.

4) Clarify Your Return and Refund Policies

Refund and return policies have a huge effect on customer loyalty. Well-constructed policies can even transform negative experiences into positive ones, making them worthwhile if you’re prioritizing market growth and loyalty. Transparent policies also build trust and prevent potentially costly disputes that can tie up your e-commerce store’s resources.

5) Utilize Automation Wisely

Use automation tools to manage the payment processes and the systems connected to them. For a start, set up automated invoicing and email reminders for overdue payments to eliminate the need to perform these tasks manually.

You’ll also want to make sure that your inventory management and marketing automation systems are synced to your payments so that critical information like stock levels and buying patterns are available to those systems' users in real-time.

6) Always Keep Security in Mind

At the minimum, your payment system must comply with accepted security standards, such as the Payment Card Industry-Data Security Standard (PCI-DSS). However, the minimum is not always sufficient, given how innovative malicious online actors have become. Periodically look into the latest security measures and implement what works to effectively protect your customers’ data.

7) Provide Detailed Standardized Receipts

Local tax agencies will require official receipts for most transactions, including those made by e-commerce sites. Knowing that, make it a part of the standard policy to include the payment method used, the amount paid, and the transaction date.

8) Invest in Your Staff

Your policies are only as effective as your team's. Any employee handling transactions need to be well-trained in your incoming consolidated payment policies and fully capable of handling complex inquiries. Invest in all the time necessary so that your staff can answer questions within seconds and have little need to escalate things to provide customers with the answers they want.

9) Continually Improve Your Site’s Policies

Payment environments are not static, so it makes no sense for payment policies to remain the same from year to year. Schedule an annual review of your payment policy and update it to better solve customer needs and real market conditions.

10) Communicate Policy Changes to Customers

Whenever you make changes to your payment policies, communicate them clearly to your customers. Use email notifications and site banners to announce your imminent changes so that customers have time to adjust. If you’re active on social media, make sure to post your announcements there as well.

Are Your Payment Processes Holding Your Business Back?

Payment consolidation is about far more than just offering convenience. It effectively lifts the brakes off of your e-commerce business’s growth by encouraging loyalty and opening up access to more customers.

Thankfully, with modern online payment solutions and best practices, there is no reason to stick with a convoluted mess of individual payment policies for different payment types. With the right elements in place, you will eventually achieve a streamlined, unified set of payment processes that converts customers and keeps them coming back.

Image Source: https://www.freepik.com/

Recommended For You:

Robotic Process Automation in E-Commerce: Benefits & Use Cases